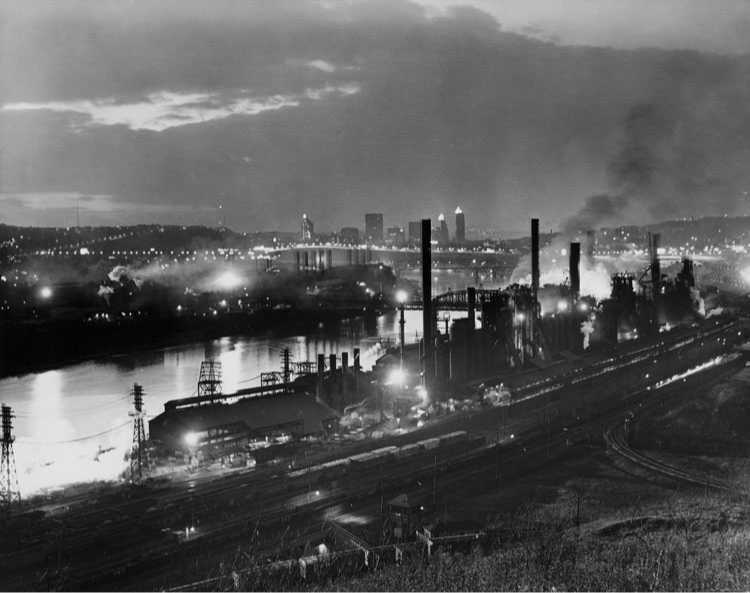

The iron and steel industry was also intensely competitive. Despite the trend toward higher production, demand varied erratically from year to year, even from month to month. In good times producers built new

This early 1900 photograph shows how steel mills spread along the riverfront of Pittsburgh, Pennsylvania.

Facilities, only to suffer heavy losses when demand declined. The forward rush of technology put a tremendous emphasis on efficiency; expensive plants quickly became obsolete. Improved transportation facilities allowed manufacturers in widely separated places to compete with one another.

The kingpin of the industry was Andrew Carnegie. Carnegie was born in Scotland and came to the United States in 1848 at the age of twelve. His first job, as a bobbin boy in a cotton mill, brought him $1.20 a week, but his talents perfectly fitted the times and he rose rapidly: to Western Union messenger boy, to telegrapher, to private secretary, to railroad manager. He saved his money, made some shrewd investments, and by 1868 had an income of $50,000 a year.

At about this time he decided to specialize in the iron business. Carnegie possessed great talent as a salesman, boundless faith in the future of the country, an uncanny knack of choosing topflight subordinates, and enough ruthlessness to survive in the iron and steel jungle. Where other steel men built new plants in good times, he preferred to expand in bad times, when it cost far less to do so. During the 1870s, he later recalled, “many of my friends needed money. . . . I bought out five or six of them. That is what gave me my leading interest in this steel business.”

Carnegie grasped the importance of technological improvements. Slightly skeptical of the Bessemer process at first, once he became convinced of its practicality he adopted it enthusiastically. In 1875 he built the J. Edgar Thomson Steel Works, named after a president of the Pennsylvania Railroad, his biggest customer. He employed chemists and other specialists and was soon making steel from iron oxides that other manufacturers had discarded as waste. He was a merciless competitor. When a plant manager announced, “We broke all records for making steel last week,” Carnegie replied, “Congratulations! Why not do it every week?” Carnegie sold rails by paying “commissions” to railroad purchasing agents, and he was not above reneging on a contract if he thought it profitable and safe to do so.

By 1890 the Carnegie Steel Company dominated the industry, and its output increased nearly tenfold during the next decade. Profits soared. Alarmed by his increasing control of the industry, the makers of finished steel products such as barbed wire and tubing considered pooling their resources and making steel themselves. Carnegie, his competitive temper aroused, threatened to manufacture wire, pipes, and other finished products. A colossal steel war seemed imminent.

J. P. Morgan, the financial genius, staved off ruinous competition among steel firms by combining most companies into a single huge firm, United States Steel.

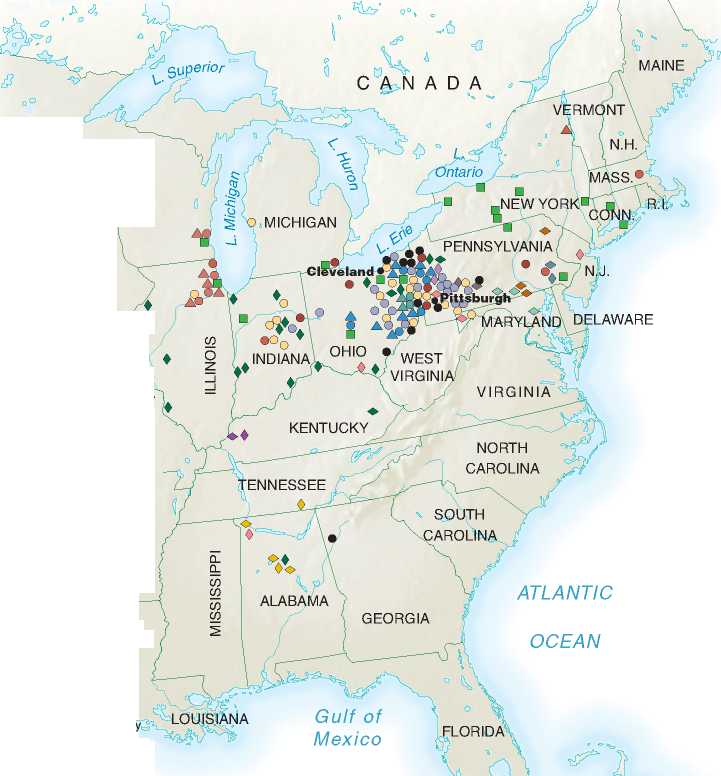

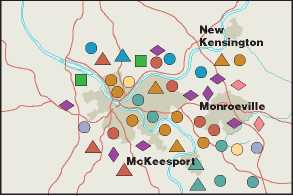

However, Carnegie longed to retire in order to devote himself to philanthropic work. He believed that great wealth entailed social responsibilities and that it was a disgrace to die rich. When J. P. Morgan approached him through an intermediary with an offer to buy him out, he assented readily. In 1901 Morgan put together United States Steel, the “world’s first billion-dollar corporation.” (See the map on p. 468.) This combination included all the Carnegie properties, the Federal Steel Company (Carnegie’s largest competitor), and such important fabricators of finished products as the American Steel and Wire Company, the American Tin Plate Company, and the National Tube Company. Vast reserves of Minnesota iron ore and a fleet of Great Lakes ore steamers were also included. U. S. Steel was capitalized at $1.4 billion, about twice the value of its component properties but not necessarily an overestimation of its profit-earning capacity. The owners of Carnegie Steel received $492 million, of which $250 million went to Carnegie himself.

Type of Plants:

?

?

Crucible Steel Co. of America

I-1 Tennessee Coal, Iron,

And Railroad Compan'

/ Blast furnace O Rolling mill, steel work n Bridge building plant Companies:

I I The Carnegie Co.

I I Federal Steel Co.

National Steel Co.

I I National Tube Co,

American Steel and Wire Co. of New Jersey American Tin Plate Co, American Steel Hoop Co. I I American Sheet Steel Co' American Bridge Co.

Lake Superior Iron Mines Independent Firms:

O Blast furnace <0 Rolling mill Companies:

Republic Iron and Steel Co.

Bethlehem Steel Co.

Lackawana Iron and Steel Co.

Pennsylvania Steel Co. of New Jersey

Cambria Steel Co.

|

Lake Erie |

ZT O | |

|

1 A | ||

|

_iJ |

A A |

Jones and Laughlins Ltd

Pittsburgh Cleveland

Firms Incorporated into U. S. Steel J. P. Morgan's consolidation that created U. S. Steel.

World History

World History